Founder Journey: Hello Europe!

Germany. Finally. The ask worked. But so did the give.

“If there’s one thing I live by, it’s this: ask and it will be given to you.”

I’ve been giving…time, effort, faith, pieces of myself with no receipt. But asking takes a different kind of bravery. A vulnerable kind. And the kind that admits that I want this.

So when you pair that with the right kind of give, doors start cracking open like they were waiting for you all along.

Will I see you at hlth.Europe this week? Respond this email :) Let’s connect!

Gen Z Decode: Recession Indicators

Gen Z TikTokers have popularized the tongue-in-cheek trend of labeling everyday behaviors and nostalgic throwbacks as “recession indicators.” On social media, nearly anything can be jokingly pointed to as a sign of an impending downturn – from brewing free office tea instead of buying a pricey latte, to the sudden resurgence of early-2000s fashion like capri pants and high-top sneakers. The phrase “recession indicator” has effectively become a cultural punchline on TikTok and Instagram, used to turn mundane observations (e.g. juice boxes or old logo t-shirts appearing in stores) into “viral economic signals”. This is called the lipstick effect. It basically says that during a recession or an economic slowdown, people just stop buying big luxury items like cars, designer bags, or vacations.

But they don't stop spending altogether. Instead, they shift into smaller luxuries, emotional purchases, tiny treats that feel special without feeling reckless. Like the $20 strawberries from Eron. You guys know exactly what I'm talking about. I talk about this in the “aspirational middle”.

It's just indulgent enough to feel like a luxury, but not so expensive that it triggers guilt. And when people feel financially anxious, they downsize their luxuries and not their desire for comfort. And if you really wanna spiral, there's also rising tariffs on imports from China, as you guys already know.

So yes, people are stocking up on all sorts of blind boxes, and this is just one of 'em. So yeah, this might be a toy, but it's also a micro reflection of how we're coping with money, stress, uncertainty, and the need for a little hit of joy. So the next time someone judges your emotional support toy, just remind them this is macroeconomics, actually.

The meme typically works by taking some cultural déjà vu or frugal choice and facetiously framing it as proof that “the recession is upon us.” For example, users have quipped that seeing A-list celebrities do low-budget mobile game ads or pop stars from their childhood (like a famous 2000s singer) topping the charts again are surefire signs of economic trouble In essence, Gen Z is “tracking vibes” more than data – turning collective anxiety into inside jokes that resonate across their feeds.

From a cultural/psychological perspective, this phenomenon illustrates how digital-native young adults process bad news. Rather than reading dry economic reports, many are getting their cues from viral memes, which doesn’t mean they misunderstand the issues – only that they’re communicating them differently. Humor becomes a “cultural mirror” reflecting how Gen Z deals with financial pressure: by blending worry with wit in the infinite scroll of the internet. Importantly, the nostalgia in these jokes (like the return of snacks or styles from childhood) creates a sense of déjà vu that “we’ve been here before” – a callback to the 2008 crisis many remember from childhood. Labeling a familiar trend as a recession core aesthetic (a term now circulating online) is Gen Z’s way of wryly saying, “uh oh, this feels like last time.” It’s equal parts sardonic humor and sincere anxiety about history repeating.

Not everyone views this lightly. Some economists worry that saturating social feeds with recession memes could spread misinformation or needless panic. Indeed, the viral nature of these posts means economic anxiety can become “algorithm-friendly” – amplified through likes, duets, and reposts in a 24/7 cycle. Repeating the jokes often enough can make the bleak sentiment start to feel real. However, many young people defend the trend as collective coping rather than “manifesting” doom. For Gen Z, joking about layoffs and high grocery prices is a way to acknowledge harsh truths (like job security feeling mythical, or a cart of groceries costing more than dinner out) without succumbing to despair. In short, economic anxiety humor fulfills a psychological need: it builds community through shared laughter at a time when so much, from rent prices to career prospects, feels precarious and out of one’s control.

Women’s Healthcare Access in a Downturn: What Past Data Reveals to Us

Healthcare becomes optional. Nearly 1 in 4 women skipped gynecological care or birth control visits during the 2008 recession. Financial triage, not preference.

Cost > Consistency. 12% of women admitted to skipping or rationing birth control to save money. Among financially stressed women, that number tripled.

Insurance is fragile. Job losses = health coverage losses. Women’s unemployment spiked 3 pts higher than men’s during COVID, triggering what many dubbed the “she-cession.”

Worry compounds. 91% of women in tough financial spots reported increased money anxiety. 57% feared losing their job and health insurance.

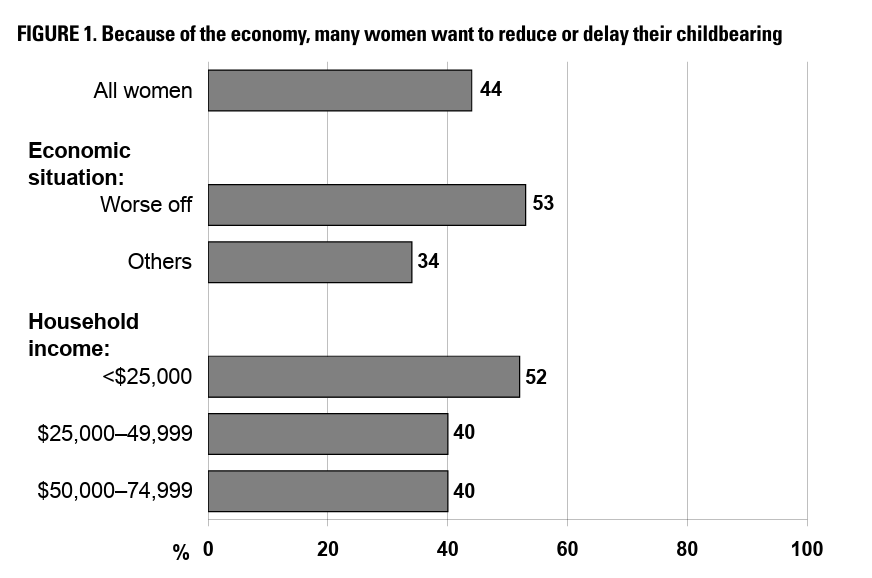

Fertility planning is economic planning. 44% of women reported delaying pregnancy or having fewer children due to the recession. Recession = contraception as a financial strategy.

Shift to long-term solutions. Uptick in interest in IUDs, implants, and sterilization. Women are opting for control, not risk, when life feels unstable.

During a downturn, security, access, affordability, and autonomy are the core offerings. Trust becomes the most valuable asset.

Signals in FemTech: What Recession-Era Behavior Means for Innovation

DIY health is in. Gen Z and Millennials are doubling down on wellness but trading $200 spa days for $20 yoga apps, reusable products, and telehealth kits.

At-home = high trust. From hormone tests to STD kits, women are opting for remote, self-guided care. The McKinsey playbook: “Optimize cost-to-value.”

Mental health is non-negotiable. Gen Z expects digital tools for anxiety, mood, and stress. Think period trackers that double as therapy logs.

Brands = community. Safe spaces (online forums, TikTok lives, peer-led wellness chats) build emotional moats. Connection is the new conversion funnel.

Venture confidence remains. While overall healthtech funding dropped, femtech grew ~5%. Investors are treating women’s health as a long-game category.

Priorities are shifting. IVF demand dips as preventative health, immunity, and nutrition rise. Founders should read the room. Wellness ≠ vanity in this cycle.

The market isn’t disappearing. It’s just re-pricing what “value” looks like.

Gen Z is still showing up for health and wellness, just in smaller, smarter ways. A yoga app instead of a retreat. An IUD over uncertainty. A meme to process what’s quietly terrifying. They’re choosing tools that offer control.

Femtech isn’t a luxury category anymore. It’s becoming a utility—like Wi-Fi or weather alerts. Useful, regular, quietly life-altering. The brands that will matter are the ones that feel like infrastructure for your insides.

Most people are building their health in small ways that feel doable. Nothing loud. Just what works. And if you can speak to that, if you can meet this generation where the stress lives in their group chats, in their impulse purchases, in the comments under a mental health TikTok then you’ve already built the beginning of trust.

And right now, trust is the most valuable thing anyone has to offer.

All Things Femtech is an entirely reader-supported publication that unpacks the psychology behind what young women are actually buying and why. If you read it every week and find these cultural insights valuable, consider liking or sharing this essay or becoming a paid subscriber! Or consider buying me a coffee instead!

Curation:

Daya raises capital to expand its global femtech ecosystem

IVI RMA GLOBAL and Gaia partner to broaden access to value-based fertility care

Progyny becomes first women’s health provider integrated with Amazon Health Benefits Connector

Study reveals privacy & security flaws in leading femtech apps

MyPause launches symptom-specific menopause supplements

New NLP model extracts menstrual health features from doctor notes

Longer reproductive span linked to better brain health

Deal Sheet and VC:

ReproNovo lands $65M to shake up the future of reproductive health

Samphire Neuroscience raises $5M to scale its wearable for menstrual pain

Hims & Hers to acquire ZAVA, expanding into four major European markets

Eli Health raises $12M Series A for instant, saliva-based hormone tracking

Somnee secures $10 M for AI‑powered sleep headband