The Rise of Aspirational Wellness. Cosette’s $430M M&A Play for Women’s Health. Amazon’s Quiet Crackdown on Vaginal Health

The future of women's health is being shaped whether through million-dollar deals, consumer trends in wellness, or the invisible algorithms deciding what products we can (or can’t) access.

Founder Journey: Self-Doubt is Brutal, But You Don’t Have to Let It Win

Self-doubt is brutal.

I was talking to a friend about it on my usual kayak routine somewhere in Finland while prepping for Slush in Helsinki. He’s building his thing somewhere and I was building mine. The conversation went like this:

Me: “There’s a good chance I get funding for my project. But I’ve been putting it off since April because…

Imposter syndrome. I just graduated. Quit a job I didn’t even start. No ‘real’ work experience. Just me, hopping around the world, ‘figuring it out.’ Which, shocker, is not a long-term financial plan.

I was afraid to underperform.

But I spent months trying to build confidence.”

His response:

"It’s okay to have the syndrome.

It’s not okay to give it power."

I didn’t take the money. Maybe I should have. Maybe I shouldn't. Doesn’t matter now. What matters is I spent too long letting doubt steer.

So if you’re in that place, figure it out. Just like every other founder in this game pretending they have all the answers.

What’s the biggest moment of self-doubt you’ve had as a founder? I get it.

In today’s newsletter: Gen Z’s contraceptive shift // Amazon’s quiet crackdown on vaginal health products // The collapse of VC-backed women’s health clinics // Cosette’s $430M M&A deal // The next era of wellness and “masstige” among Millenials and Gen Z.

Curation:

Gen Z Is Ditching Hormonal Birth Control for "Natural" Alternatives: The wellness-to-misinformation pipeline is shifting contraceptive habits. Dr. Janet Barter, president of the Faculty of Sexual and Reproductive Healthcare, is raising concerns about Gen Z women turning away from hormonal birth control in favor of “natural” methods, influenced by wellness culture and distrust of pharmaceuticals. The shift has coincided with a rise in less effective contraception methods and increased abortion rates in England and Wales. (The Times) The wellness industry has successfully reframed everything from skincare to nutrition as part of a high-performance lifestyle. So why is contraception still being marketed like a medicalized burden instead of an optimization tool? The demand for “clean” and “natural” alternatives isn’t going away, but the challenge (and opportunity) lies in repositioning evidence-based contraception within the same aspirational framework Gen Z already buys into.

Amazon quietly restricting vaginal health products. Women’s health brands are taking a hit as Amazon limits the visibility and advertising of vaginal health products, labeling them “potentially embarrassing.” VuVatech, which makes vaginal pain relief devices, is among the companies reporting revenue loss due to the restrictions (Wired). Amazon’s content policies are a reflection of a broader problem which is that women’s health is still treated as niche, sensitive, or taboo, even when it addresses medical conditions. The real issue here isn’t just lost revenue but the reality that e-commerce platforms act as gatekeepers, shaping what consumers see and ultimately, what they have access to. As companies scale, their biggest challenge won’t just be developing innovative products, but navigating the digital infrastructure that determines whether or not those products reach women at all.

HerMD is shutting down. The women’s health provider known for its focus on menopause and sexual health is closing all locations by March 2025 despite raising $18M last year for expansion. The company cited “ongoing challenges in healthcare,” but no specifics were given. A major loss for insurance-covered, specialized care. (Femtech Insider) Scaling brick-and-mortar femtech is hard. HerMD’s closure raises questions about the viability of VC-backed clinics, the sustainability of accepting insurance, and what investors will fund next in women’s health.

Deal sheet and Fundraising:

Cosette Pharma’s $430M Play for Women’s Health AKA Private Equity is Betting Big

Cosette Pharmaceuticals just acquired Mayne Pharma for $430M (Business Wire), positioning itself as a dominant player in women’s health and dermatology. The deal wasn’t a distressed asset buyout but rather a strategic move for long-term growth. Mayne Pharma, fresh off a multi-year turnaround, had already optimized margins and hit $100M in annual sales at an 80% gross margin. Cosette paid a 40% premium, signaling confidence in the company’s value beyond a quick financial flip. This is also a private equity story, Avista Healthcare Partners (Cosette’s backer) is making aggressive moves in women’s health, having previously facilitated Cosette’s Ambien acquisition from Sanofi U.S. in 2023. With pharma’s growing interest in female-focused treatments (now accounting for 60%+ of revenue at top pharma firms) (McKinsey), expect more cross-border acquisitions as companies race to consolidate market share in high-margin, underdeveloped space. Women’s health is becoming an investment thesis for institutional capital, but in practice, it’s still treated as niche in distribution, advertising, and accessibility.

Riley Raises $3.1M. But the Real Challenge: Will AI Solve Parental Anxiety or Just Add to the Noise?

Riley, an AI-powered parenting app, just secured $3.1M in seed funding from True Ventures to cut through information overload and offer personalized, science-backed insights for parents. Founder Amanda DeLuca (ex-Google, Etsy) built Riley after realizing that most parenting resources are a mess of conflicting advice. So she’s betting on AI to provide structured, actionable support. But the question is: Do parents actually want AI parenting coaches? There’s clear demand for credible (read: not influencer-led) advice, but trust in AI-driven health tools is still shaky, especially in emotionally high-stakes areas like child-rearing. If Riley nails the execution such as delivering real value, not just repackaged generic insights, it could create a meaningful place in the growing parenting-tech space. Otherwise, it risks becoming another app parents download, stress-scroll, and eventually abandon. But I’m genuinely hopeful.

Millie Raises $12M to Scale Midwifery But Will the U.S. Finally Catch Up? Millie just secured a $12M Series A to expand its midwifery-led maternity care model which is a big bet on fixing the U.S. maternal health crisis. Right now, over 35% of counties are maternity care deserts, maternal mortality rates are abysmal, and midwives still only attend 12% of births, despite proven outcomes. In contrast, Europe has already figured this out and midwives handle the majority of deliveries. But Millie has results of 30% fewer C-sections, 67% better preterm birth outcomes, which prove the model works. The real question: Can they scale fast enough? With new clinics launching in 2025, starting in San Jose, Millie is pushing midwifery into the mainstream. If they crack reimbursement and expansion (where many have stalled), this could be a major shift U.S. maternity care desperately needs.

Gen Z De-Code: ‘Masstige’ and Aspirational Wellness

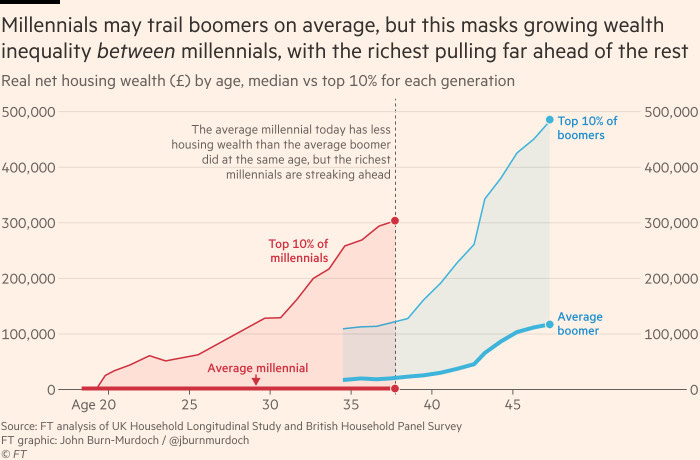

Words and their meanings shift over time. That’s no exception for the meaning of ‘luxury’ in the 2020s. It’s no longer just about price or exclusivity but rather about access, community, and identity. We’re watching in real time as masstige (mass + prestige) reshapes the way brands approach the widening wealth gap among Millennials and Gen Z. And nowhere is this more apparent than in female wellness.

Luxury isn’t what it used to be. Having a home, kids, and even basic healthcare access now feels aspirational. For a growing number of young consumers, wellness itself has become a status symbol. The top 10% can afford $200/month personalized supplement subscriptions, boutique fitness classes, and hormone therapy on demand. The average consumer? She’s trying to balance “essential luxuries” like an overpriced oat milk matcha and a $30 co-pay for a doctor’s visit.

This means brands have to be more strategic than ever. It’s not enough to be either high-end or budget-friendly, wellness brands now have to operate in both worlds without alienating either group. It’s why we’re seeing private-label functional beverages at Whole Foods that cost $4.99 while Erewhon charges $20 for a celebrity-backed smoothie with nearly the same ingredients.

Women’s health and wellness is at the center of this shift. The rise of fertility, hormonal balance, and longevity products should not just focus on the science but start to prioritize the branding. These are not just healthcare solutions anymore. It has become more about selling an aesthetic of control and empowerment. The woman who takes seed cycling supplements and tracks her Basal Body Temperature with a $300 Oura Ring on a Buy Now Pay Later is the same woman who buys into an entire identity of high-performance wellness. Meanwhile, mass-market brands are working to make similar products “accessible” while still leveraging the same aspirational messaging.

The “middle-class luxury” model allows brands to straddle both markets: offering affordable versions of wellness essentials without diluting their exclusivity. We see this with direct-to-consumer supplement brands that offer subscription tiers, Buy Now Pay Later options, and micro-dose luxury through aesthetically packaged, “science-backed” essentials. Functional beverages, hormone-balancing gummies, and premium skincare backed by biotech are now a form of social capital.

The real play here? Branding wellness as an indispensable part of self-optimization. If Millennials were sold the idea of work-hard-play-hard, Gen Z is being sold biohacking as a baseline requirement for success. And when survival itself starts to feel like a luxury, wellness brands have to market both necessity and indulgence in a way that keeps both top-tier and budget-conscious consumers in the game.

Building in women’s health? I want to hear from you.

If you're a founder, investor, or operator driving change in femtech and women's healthcare, let’s talk. I’m always looking for sharp insights, emerging trends, and real-world perspectives to feature in my newsletter. Get in touch if you have something worth sharing.